MARKET VOLATILITY, OPEC WATCH, AND NATURAL GAS MOMENTUM

A recurring theme in industry conversations lately is uncertainty. As observed over the past week, geopolitical dynamics continue to drive significant volatility in oil markets. Following a missile strike in Iran and a subsequent ceasefire, WTI crude prices dropped 12.6%—falling from $74.93 to $65.52 in just one week. The trajectory of oil prices remains highly unpredictable, and the current administration’s “Drill, Baby, Drill” stance only adds to the speculation.

In a recent webinar with David Pursell and Mark Meyer, both offered valuable insights into these volatile dynamics. Attention is now firmly fixed on the upcoming OPEC meeting this weekend. There was some debate on whether OPEC’s current strategy is shifting—not necessarily targeting price control, but potentially aiming to regain market share as non-OPEC producers like the United States and Canada continue to perform robustly. Such a move could introduce downward pressure on oil prices.

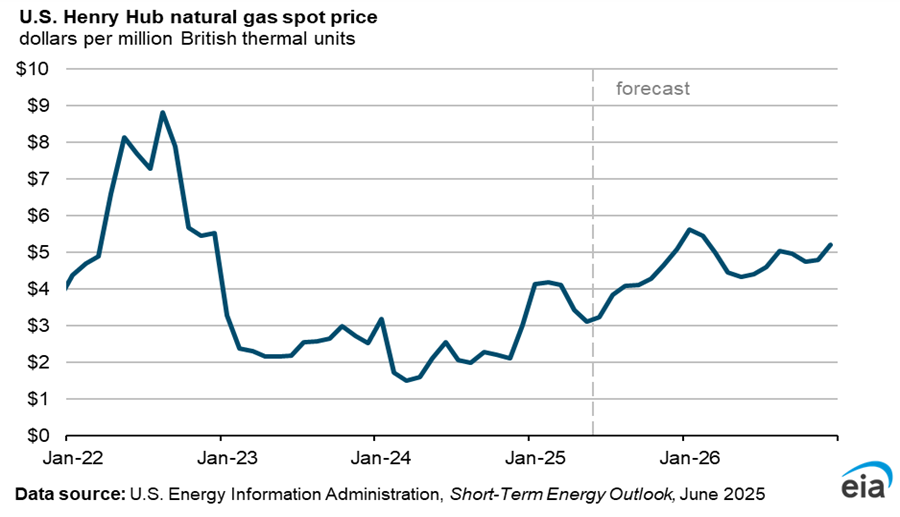

This led to an engaging discussion on the strength of the natural gas market, where there appears to be more visibility into rising demand—particularly as power needs escalate. The latest outlook from the U.S. Energy Information Administration (EIA) supports this view:

“We expect natural gas prices to increase throughout the summer as production declines slightly and demand for air conditioning increases the use of natural gas in the electric power sector. The Henry Hub spot price in our forecast averages more than $4.30/MMBtu in the second half of 2025, up from the May average of $3.12/MMBtu.

The average natural gas price at the Henry Hub in our forecast rises by more than 80% in 2025 compared with 2024. We expect that domestic consumption and exports combined will increase by nearly 4 Bcf/d this year, while U.S. dry natural gas production grows by less than 3 Bcf/d.

Although natural gas inventories have recently moved above the five-year average, we expect that as demand persistently outpaces supply through much of this year, inventories will fall back below the five-year average by October, putting upward pressure on prices.”

Short-Term Energy Outlook - U.S. Energy Information Administration (EIA)

Special thanks to David and Mark for their thoughtful contributions to the Collide community. In the near term, geopolitical risks remain elevated, and all eyes are on OPEC—especially to see whether any shifts in production policy have already been priced into the market.

**Circling back to a previous thread—I realized I never closed the loop on my running season update. The Dallas Marathon last December was exceptionally humid, which forced several last-minute adjustments. While it wasn’t a race for a PR, I’ve stayed committed to improving mile times.

During this offseason, I have incorporated alternative cardio workouts, particularly rowing, which has been a great way to build strength alongside running. As the summer heat intensifies, I’m continuing to experiment with gels and electrolytes to address cramping and maintain performance. With upcoming travel and hunting trips, I’m hopeful that this training will translate into better energy levels and endurance. The journey has been both challenging and rewarding.